First of all, we can celebrate. At this very moment you are reading this article, a new reality is already being established in our society. A reality in which each of our actions, both as individuals and as associations, institutions, organizations and companies, is being done consciously and with a view to generating and expanding positive and proactive social and environmental impact.

And the best part is that this whole process is becoming more and more genuine, more truthful, more connected to what people think, feel and say… because it simply makes sense, it feels right, to each and every one of us. We often say that this “wave”, which was hitting our shores harder and harder, finally came in 2020 like a tsunami, destroying an old way of doing things and paving the way for this new irreversible reality.

In the corporate world, this tsunami has been given the name ESG.

What is ESG?

When we prepare to enter a new territory, what guides us is a map. And in this new territory, where business expansion is intrinsically aligned with the generation of positive and proactive social and environmental impact, we have several maps at our disposal. These include the vast field of sustainability, social responsibility, shared value, social business, impact investment, conscious capitalism, B Corporations, etc.

Currently, one of the most commonly used terms to refer to these maps is ESG.

When we talk about ESG, we’re talking about an expansion of the traditional boundaries of the corporate market. We are going beyond the economic and financial vision of a company, expanding our understanding of its role, its responsibility and its social and environmental impact on the world. ESG is an acronym that refers to a corporation’s Environmental, Social and Governance (decision-making, transparency and integrity) agenda.

It’s as if, without ESG, we would only describe a person’s value by their salary and wealth. And this would be the most important element of all. For some people, this is undoubtedly (still) the main measure of success. However, this measure is only a snapshot of reality, it’s a choice made by those who evaluate. So a certain person is worth more than another because of their material wealth, leaving aside their personal life, how they act with their children, how their lifestyle impacts the environment, their inner suffering and virtues, their artistic talents and the well-being this brings?

So ESG broadens the understanding of what the value of a company is, and what a company is as a whole. ESG expands the range of understanding, the field of vision, illuminating the other rooms of a company, just like in a house, when we were only looking at the living room. It then brings in not only the economic and financial, but also the social and environmental elements intrinsic to the corporate operation.

ESG is an evolving process

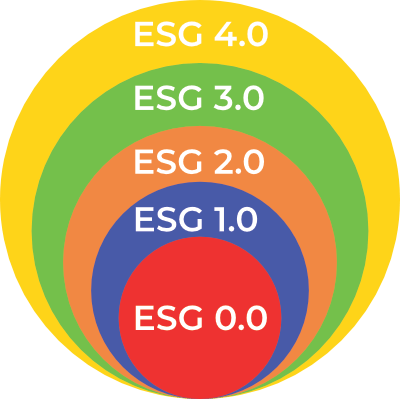

Like any movement, the ESG is an evolving process. This means that there is a current and contemporary configuration of what the ESG is, just as there are its previous, or less complex, versions and its future versions, which are a trend and which are more complex and comprehensive. Each of these versions complements each other, so that a new version transcends and includes the previous ones, without negating or even excluding them.

ESG 0.0 – Unilateral will to positively impact a cause familiar to the leadership

The most basic and elementary version of ESG, or ESG 0.0, is one in which actions with a positive social and environmental impact come from the unilateral will, and sometimes even from the ego of the company’s owners, top management or those directly responsible. The choice regarding the impact generated comes from their field of knowledge, personal experience or preference for a specific topic.

For example, a company that makes monthly donations to an old people’s home, with the origin of this action being the perception of one of the owners who identifies with this cause. Also applicable to this level of ESG is the priority and exclusive focus on the organization’s employees. This is an impact action that is not necessarily aligned with the company’s expertise or operations, nor has it been externally identified as a latent demand from the organization’s stakeholders.

ESG 1.0 – Institutional alignment for compliance and adherence to norms, rules and laws

In a slightly more complex version, ESG 1.0 broadens the scope of vision of positive impact, integrating a certain collectivity into the process, and no longer originating entirely or solely from the individual perspective of the organization’s leadership.

At this level, ESG has an institutional aspect based on compliance, i.e. conformity with rules, laws, regulations, norms or cultures that strongly influence an organization. ESG is understood here as the “right” thing to do, based on a higher value base that is “above” the company, be it legislation, local culture, religion or even the corporation’s non-negotiable internal values. One example is an organization’s compliance with environmental and social legislation.

What stands out here are companies that take on and incorporate existing standards even when they are not mandatory, such as joining the Citizen Company program, or are not being widely implemented even though they have been formalized in law, such as the National Solid Waste Policy and reverse logistics.

ESG 2.0 – Strategic focus on real and measurable results, both economic and in terms of impact

Integrating and transcending the two previous versions of ESG, ESG 2.0 is defined as an essentially strategic and economic ESG.

At this level, the company relates to social, environmental and governance issues from the perspective of the business, its operations, its market, its market share and its consequent profitability. ESG thus includes an essential aspect of capitalist economic logic, which is the focus on the results of actions taken. This focus on results gives ESG a very positive impetus, in the sense that the actions related to it must generate an effective, real and measurable positive impact, i.e. categorically generate results in themselves.

On the other hand, this perspective risks exploiting some ESG aspects with a purely marketing objective. This can be clearly seen in the first versions of the Bottom of the Pyramid (BoP) concept and practices, which looked at the extreme low-income population as an untapped consumer market, justifying this strategy as “giving these people access to the consumption of products they would otherwise not be able to afford”.

A second version of the BoP model already considered including these people in the value chain, training them as suppliers or distributors, for example, and thus creating perennial and sustainable conditions for the growth and economic development of families. This second version is already based on a “healthier” version of the systematic ESG 2.0 way of thinking. This version of ESG is at the heart of the typical concepts of corporate social responsibility, the first versions of shared value and private social investment, for example.

ESG 3.0 – A systemic and interdependent view of an organization’s impact and presence

ESG 3.0, in turn, represents a major advance on previous versions, expanding the field of vision and understanding with regard to environmental, social and governance aspects.

The focus of attention shifts from within the company to the dynamics of the relationship between the organization and the context in which it is inserted, be it at local, territorial, national or even global level. This means that this version of ESG has a systemic and pluralistic basis, considering that we are all interdependent on this planet. It is about the genuine and true understanding that neither a company nor a person exists without the environment in which they are inserted, and no one remains completely healthy in a sick ecosystem.

In practice, ESG 3.0 heralds a radical change in corporate logic, which overcomes the priority of capital and the shareholder above all else, and integrates them as another element and another actor to be considered among the organization’s various stakeholders. In other words, employees, their families, the surrounding communities, nature with its fauna and flora, suppliers, customers, shareholders, citizens and all the other components of our society have their demands and interests considered as legitimate and taken into account in organizational decision-making.

In this way, it is understood that environmental and social projects are essential strategies and practices for the continuity, development and expansion of a company’s business. Movements and methodologies representative of ESG 3.0 are the more advanced models of shared value and inclusive business, conscious capitalism and much of the B Corp movement, for example.

This version of ESG 3.0 has been extremely favored, boosted and spread globally since 2020 and especially 2021, during the Covid-19 pandemic. This acceleration was so intense that the term ESG is now considered the natural “replacement” for the concept of sustainability, which had previously “replaced” the concept of corporate social responsibility in the business world.

However, even this more systemic and pluralistic understanding of ESG does not appear to be sufficient or capable, on its own, of solving the social, environmental, economic and cultural challenges present in the world today. Each of the previously described versions of ESG is important and necessary for finding sustainable and lasting solutions to these problems. However, it is crucial to understand that their real effectiveness depends on their suitability for the environment in which they are implemented.

By way of illustration, an ESG level 3.0 solution is unlikely to have a considerable impact in a given territory if there is no minimum legislation to support responsible environmental and social practices, which are typically ESG level 1.0, based on compliance and conformity. In this way, each ESG version builds on its predecessors, naturally including, improving, evolving and transcending them.

ESG 4.0 – Sustainability integrated into the strategy and essence of the business in a conscious and integral way

This is how we understand the emergence and urgency of ESG 4.0, which is defined as integral and conscious ESG.

Its main evolution, compared to previous versions, is that the positive and proactive impact of a company, whether in environmental, social and governance aspects or in others such as cultural, political and technological aspects, is intrinsic and inseparable from its business and economic activities. This means that an organization not only has a range of certified processes, products or services (fairtrade, organic, LEED, FSC, Rainforest Alliance, etc.) or adopts social and environmental practices and projects, but also incorporates the intention, purpose and commitment to generate a real and measurable positive impact in all areas of its business.

In simple terms, the more a company expands its business, the more it generates positive impact, because that is the nature and essence of its activities. Take the case of Guayaki, among many others, which produces and sells yerba mate products via a completely regenerative business model, protecting and regenerating the Atlantic rainforest and its communities in South America. In other words, ESG is fully integrated and incorporated into all aspects of the organization, even becoming an inseparable driving platform for its growth, profitability and abundance.

And this is precisely the great evolutionary leap that ESG 4.0 brings with respect to previous versions. From ESG 0.0 to ESG 3.0, the fundamental understanding is that, although a company’s main objective is to be profitable, there is no valid reason why it should not also strive to use its position of power and resources to improve the world while doing so.

Moving towards ESG 4.0 means understanding that a company’s main objective, mission and purpose is essentially to help make the world an increasingly better place for the people who live in it. This is a completely new paradigm in the world of business and the economy, where the concept of success is reframed in terms of promoting the well-being of people, the environment and society.

This perspective is even the fundamental basis of the B Corporation movement and inspires all the more recent strands on the evolution of organizations, such as, among others, the integral perspective of Reinventing Organizations and the Conscious Capitalism movement. The latter, moreover, reinforces the essence of ESG 4.0 by ensuring that capitalism lived consciously is a way of thinking about business “that best reflects where we are on the human journey, the state of our world today and the innate potential of business to make a positive impact on the world”.

In fact, all of this only becomes a reality if the entire company, and especially its owners, shareholders and top management, act in a truly conscious way.

In this genuine version of ESG 4.0, companies are actively engaged in a continuous journey of self-awareness. They no longer operate from the premise that they exist to enhance their financial results above all else, a philosophy that is strongly present in ESG versions 2.0 and earlier, and transcends the perspective that shareholders and owners are yet another stakeholder to be considered, included and legitimized, typical of ESG 3.0. More than that, in ESG 4.0 the very existence of the organization and the essence of its business model are closely linked to a wide range of stakeholders, both internal and external.

In fact, the consideration of who is “part” of the organization goes beyond the illusory distinction between who is “inside” or “outside” the boundaries of the company. These boundaries simply don’t make sense in the 4.0 organizational model. What exists is a set of stakeholders, consisting of shareholders, employees, suppliers, distributors, customers, activists, neighbors or beneficiaries who are an inseparable part of the business model.

Let’s take the case of Patagonia, one of the largest activist companies in the world, and one of the most successful in integrating (or succeeding precisely by integrating) its business with a cause for positive global transformation. According to the company itself, “we recognize that all life on Earth is under threat of extinction; we are using the resources we have – our business, our investments, our voice and our imagination – to do something about it”. It was born out of a community of nature-loving climbers and surfers, and has gradually expanded its operations with a focus on representing the values of all communities that share this same yearning.

And as paradoxical as it may seem, it has become a prestigious high-quality clothing company which, at the same time, advocates minimalism, i.e. conscious, circular and restorative consumption. The planet as a whole, and all the beings that inhabit it, are an inseparable part of Patagonia’s business philosophy. By integrating this expansion of consciousness and blurring the illusory boundaries between the company and the context in which it is inserted, ESG 4.0 opens up previously unimaginable paths of innovation, growth and impact that can be generated by organizations.

What’s next? 5.0: Regenerative ESG

These five versions of ESG – unilateral (0.0), compliance (1.0), economic (2.0), systemic (3.0) and integral/consciential (4.0) – reflect the broad universe of the ESG field in the world today. They all coexist, contributing crucial aspects of the ESG agenda that complement, include and at the same time transcend each other in a hierarchy of greater complexity, also defined as a holarchy.

From this understanding, it is clear that there is a pressing evolution underway towards an emerging ESG 5.0. This, which is gradually materializing at the present time, is constituted as a Regenerative ESG, with a holistic consciential basis.

In this context, a company basically exists as a collective organism at the service of the evolution of people, society as a whole, the planet and so on. There is thus a major shift in the wisdom about an organization’s existence, as there is a migration from its individual identity to a completely collective identity, no longer limited to its traditional “borders”. Both the business, the strategic guidelines and the structure itself are shaped by the opportunities to expand their positive impact and solve local, regional and global challenges facing humanity. The mission, reason for existence or purpose is actually shaped by an organizational proexis, i.e. a specific existential action aimed at optimizing the evolutionary process of our society.

An example could be the emergence of a major corporate conglomerate whose essential purpose (organizational proexis) is to reduce the social inequality gap in various countries, through business, partnerships and advocacy, in order to increase the opportunities for development, growth and evolution of people from all socio-economic strata. At this level, “ESG” practically doesn’t exist, because environmental, social, governance and other aspects are obviously intrinsic to the organization’s existence, and what’s more, they constitute the fundamental basis on which and why it operates.

Basically, in “ESG 5.0”, the very concept of the economy migrates from “focusing on guaranteeing the survival, quality of life and well-being of people, the environment and society” to “co-constructing our own evolution and the future that is emerging right now”.

How to work with ESG?

All six versions of ESG, from 0.0 to 5.0, are ideal meta-models that summarize the essence of the level of ESG complexity present in an organization. Rarely will a company act perfectly and solely according to the characteristics of just one of these versions.

There are waves and variations within each of these six meta-models and, in practice, different models and practices related to these various strands are adopted, according to the reality, mindset and possibilities of each organization.

A company can, for example, have 5, 8, 10, 20 or even 64 or more axes of ESG action within its strategy, culture, leadership and processes. However, even if this plurality is effectively what you find in the corporate world, every organization that works with ESG ends up having a “center of gravity” in one of these versions.

For example, despite having the center of gravity of its ESG at version 4.0, Patagonia still has a formal governance structure that is typically corporate (2.0) but which obviously considers the interests of various stakeholders to be fundamental in its decision-making process (3.0), with a purpose that is totally geared towards Restorative ESG (4.0) and Regenerative ESG (5.0). The way forward is not to try to fit perfectly into one of these versions, much less to aim to “implement the most advanced version of ESG possible”, but to stitch the ESG journey together gradually, so that the business, structure, processes, culture, leadership and positive, proactive impact develop in a harmonious and sustainable way.

The importance of this practical understanding of the versions of the ESG is much more urgent than a mere conceptual exercise. This agenda, despite appearing to come from a certain “fad” and even being very recent in Brazil, is already considerably developed in the sphere of some of the most prestigious G-20 countries, and in some cases certain elements of the ESG 4.0 format of action, which integrates impact and business in an inseparable way, are being incorporated into legislation and regulations regarding corporate action within some sectors and countries.

This means that for a company wishing to expand its operations, whether regionally, nationally or internationally, the genuine incorporation of ESG becomes an essential condition. This reality is so pressing that absences, failures or gaps in the adoption of this agenda, such as greenwashing, socialwashing or even rainbowwashing (the latter relating to the 17 SDGs – Sustainable Development Goals), are today one of the biggest and most impactful corporate risks in all spheres of the economy.

The “European” ESG is already at a significant evolutionary level, and serves as a preview of how quickly this agenda will evolve in the Brazilian context, especially for high-performance and expanding companies.

And it all starts… at the beginning. Your organization has never worked with ESG and wants to start this journey?

How about starting by implementing an ESG based on 0.0 and 1.0, or even 2.0?

The positive impact that will be generated as a result will undoubtedly be greater than in previous years, and the way will be paved for the structuring of a conscious, integrated and sustainable ESG.

Or does your company already work with ESG and want to advance to a new level, in a way that is aligned with and leverages the expansion of your business?

Understanding the dynamics of the versions and waves of ESG drastically facilitates organizational planning and development in this direction. Or perhaps the goal is mainly to organize or even expand the corporation’s positive environmental and social impact.

Again, a clear diagnosis of the current level of ESG will help you understand the various possibilities for expanding this impact. Whatever your organization’s reality, we invite you to contact us about ESG 4.0 and find out more about how to implement ESG and perhaps even become a Certified B Corporation.

What’s more, on an individual and personal level, do you want to know how these ESG levels are present in your current way of thinking? Take the awareness levels test and compare your results with this legend: ESG 0.0 (red), ESG 1.0 (blue), ESG 2.0 (orange), ESG 3.0 (green), ESG 4.0 (yellow) and ESG 5.0 (turquoise).

Welcome to the new era of ESG!